Client

The Baloise Versicherung AG is a leading international insurance and financial services provider headquartered in Basel, Switzerland. Baloise offers a wide range of services, including property, life and health insurance as well as asset management. The Data Lab is a unit within Baloise dedicated to harnessing enterprise data.

Initial situation

Baloise’s Data Lab wanted to optimize the existing data-driven system for detecting suspected insurance fraud in motor vehicles with regard to key performance indicators. LogiLab was asked to support the Data Lab with its expertise in mathematical modeling and to develop an improved model framework based on the existing approach as part of a joint project.

Solution

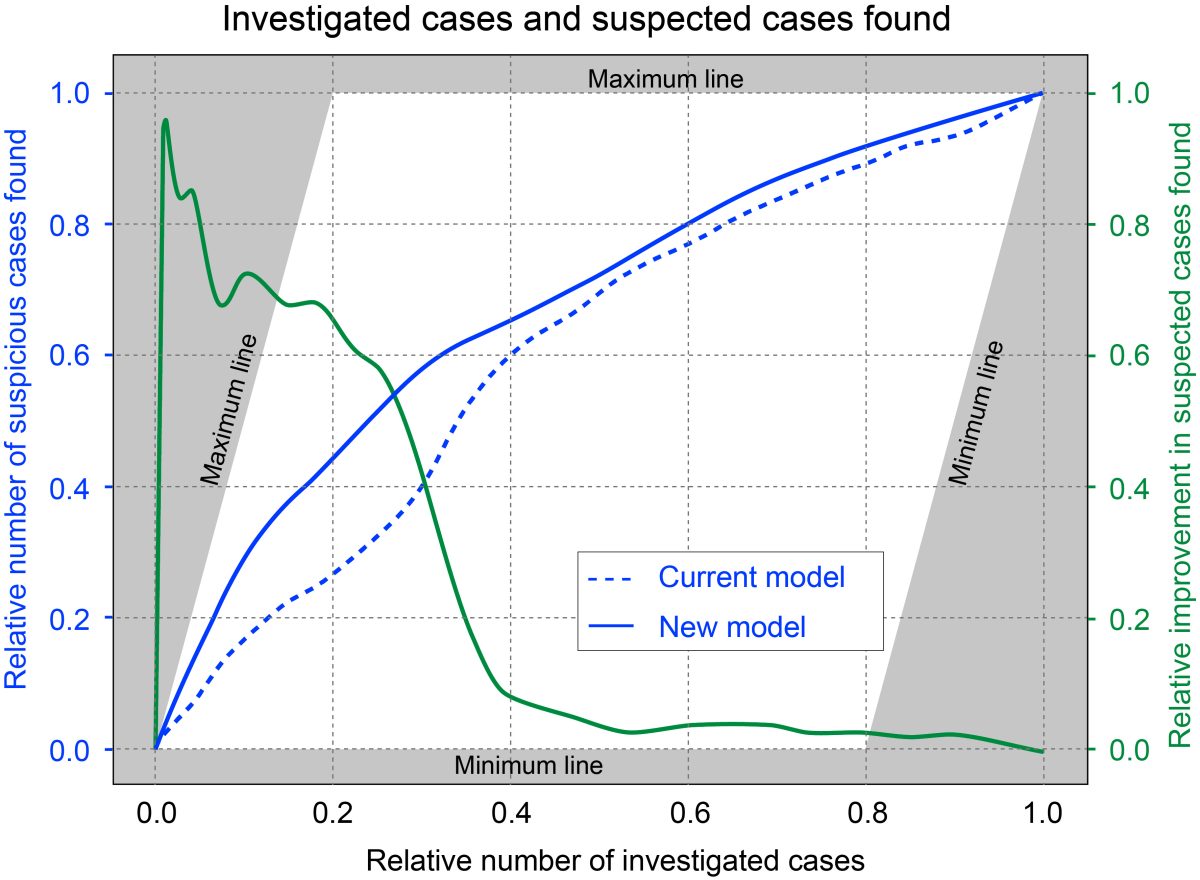

In collaboration between the Baloise Data Lab and LogiLab, an adaptive, self-learning mathematical model framework based on a weighted rule-based approach in combination with machine learning models was developed. This framework is able to optimize the fraud suspicion detection system according to different key performance indicators, such as a maximum fraud suspicion detection rate or maximum potential expected savings.

Result

Analyses of the newly developed model framework using historical data showed an approximately 65% higher fraud suspicion detection rate within the top 20% most suspicious cases compared to the current approach. Following the promising tests, the new framework is currently being implemented in the operational business.